AML/CTF Tranche 2 Hub

AML Hub for Lawyers — Powered by My Databoss

From trust-account deposits to high-value settlements — stay compliant without drowning in paperwork.

Why Law Firms Are Now in Scope

Tranche 2 brings law-firms under AUSTRAC from 1 July 2026

If your practice provides designated services — for example property conveyancing, operating a trust account, managing client funds — you will become a “reporting entity.”

You must:

Enrol with AUSTRAC within 28 days of first providing a designated service.

Implement a written AML/CTF Program (Part A & Part B).

Conduct Customer Due Diligence (CDD/KYC) on every client and beneficial owner.

Monitor clients & report suspicious activity: file Suspicious Matter Reports (SMRs), Threshold Transaction Reports (TTRs ≥ A$10 000 cash) and International Funds-Transfer Instructions (IFTIs) where relevant.

Keep records for 7 years & train all staff.

Penalties AUSTRAC can impose civil fines in the millions; Principals and Compliance Officers can be personally liable for serious breaches.

Ready to get started?

Top 5 Risk Areas for Law Firms

Typical high-risk scenarios:

Trust-account cash deposits ≥ $10 000 for property settlements.

Off-shore / high-risk-jurisdiction buyers or sellers.

Complex corporate / trust structures that hide beneficial owners.Politically Exposed Persons (PEPs) as clients or directors.

Unusual payment instructions, e.g. splitting one deposit across multiple entities.

Red-Flag Awareness Matters: These examples come from AUSTRAC’s gatekeeper-sector risk assessments.

The full Red-Flag Checklist (dozens more indicators) is included in our e-learning & compliance-guide so your staff learn what to spot in real files

See how AML/CTF fits naturally into a legal matter in My Databoss

Daily Compliance in Practice

Engage Customer invite client to secure portal

Digital-ID + biometric check (100-point ID & selfie-match)

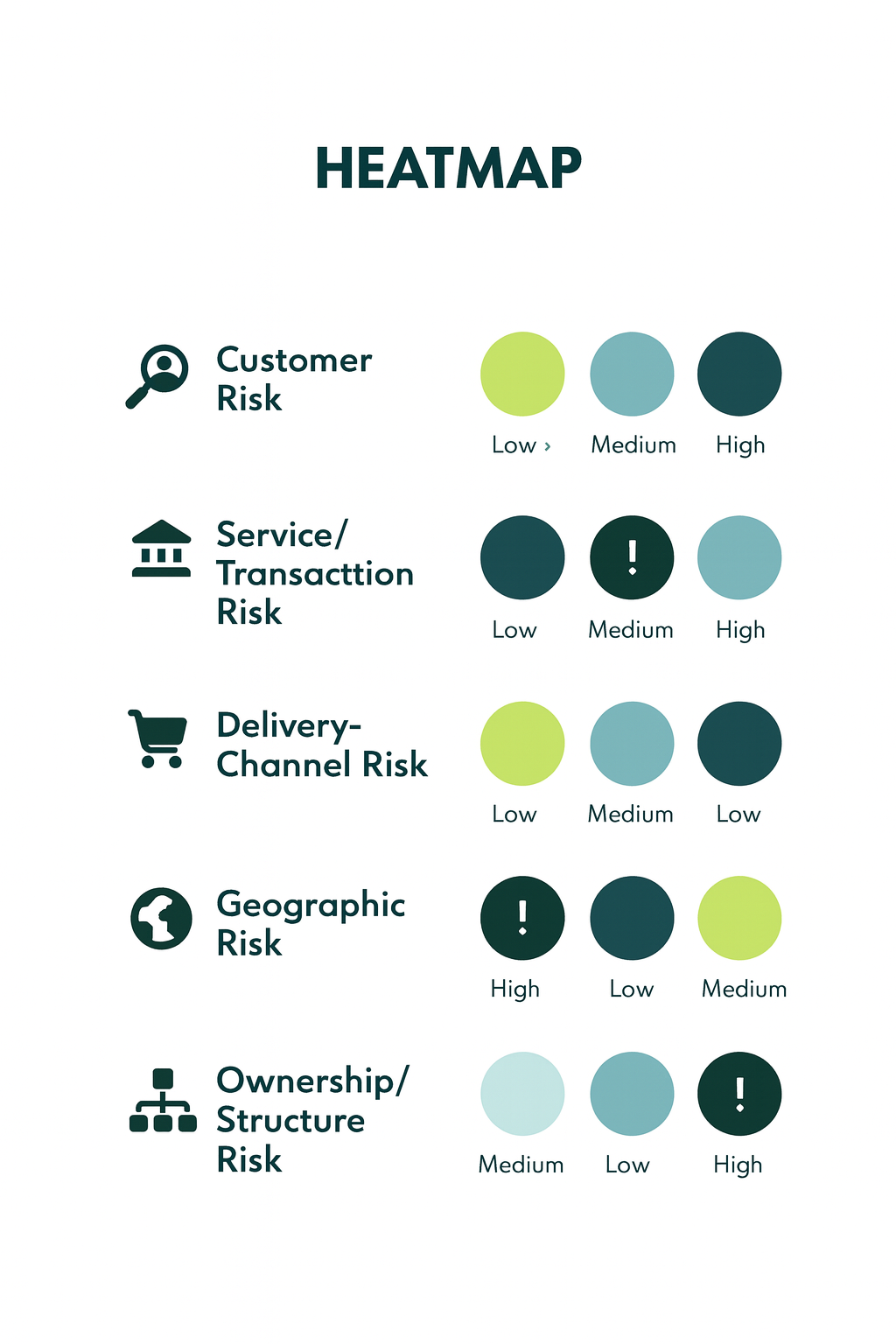

Platform auto-screens PEP / Sanctions / Adverse-Media assigns Risk-Tier

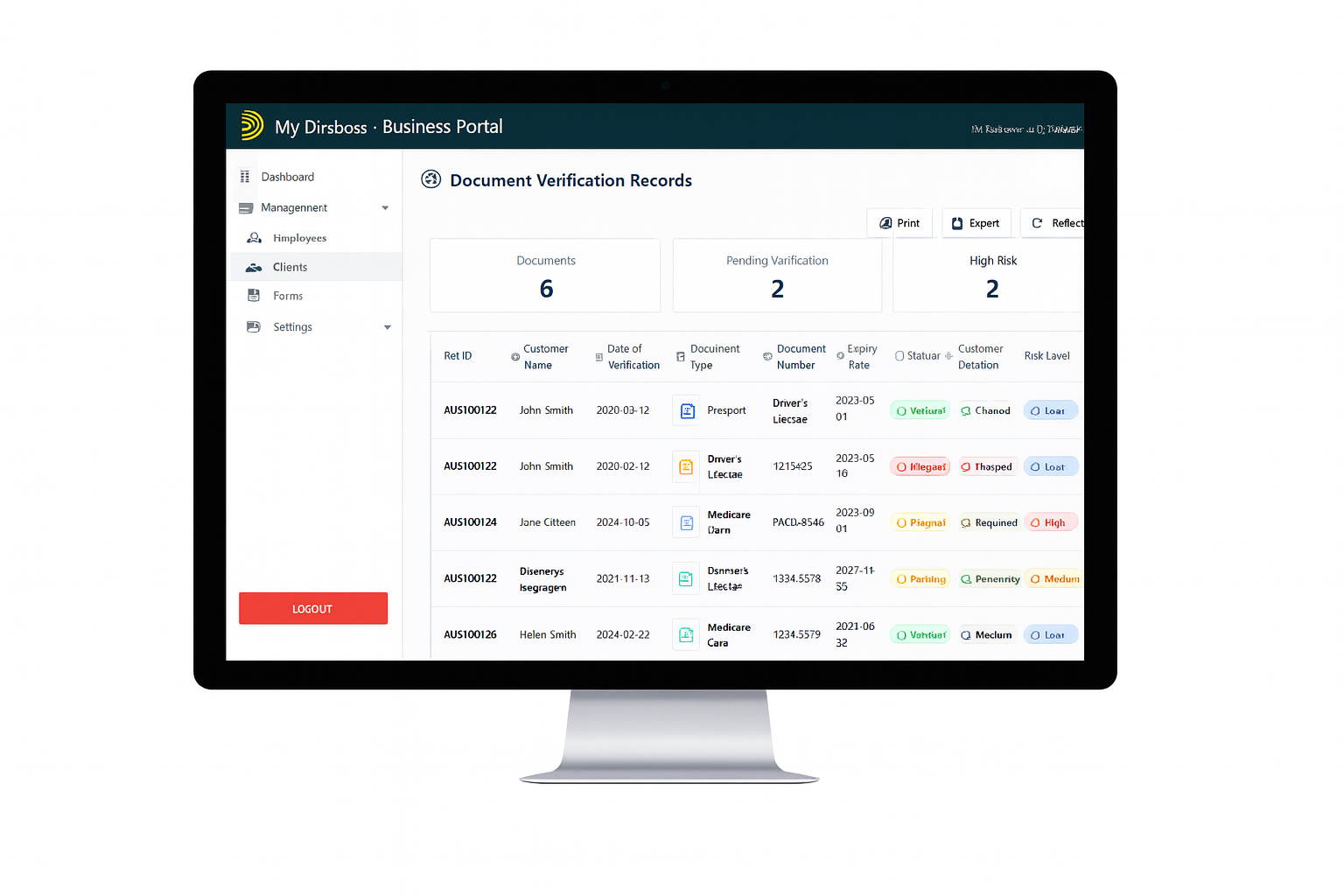

High-Risk case automatically requires EDD form + Compliance-Officer approval before trust-funds accepted

All CDD/EDD reports & supporting docs auto-stored 7 years. Dashboards feeds Internal reporting. Keep your firm audit-ready always

Trusted by

CALL TO ACTION

Step 1 Take the Free AML Readiness Quiz

Step 2 Download Your Sector-Specific Risk-Assessment Template

Step 3 Book Free Implementation Session

Step 4 Receive Compliance Guide

Why Businesses Choose My Databoss

Integrated Everything- Risk-Assessment + Guide + Training + KYC workflows + Board-reporting — all in one secure portal.

Law-Firm-Friendly- Maps to legal trust-account & conveyancing workflows; respects legal-privilege boundaries; secure encrypted vault.

Audit-Ready in Minutes- Version-controlled program docs, risk-logs, SAR register, training register. Ready for AUSTRAC inspection.

Ready to Secure Your Business?

Watch a live Demo Now

See My Databoss in Action - No Waiting Required.

Get an exclusive look at how My Databoss streamlines data security, compliance and automation. Watch our on-demand demo to discover how it works - at your convenience.