AML/CTF Tranche 2 Hub

AML Hub for Real-Estate Agents — Powered by My Databoss

From first-home buyers to offshore investors — stay compliant without slowing your sales pipeline

Why Real-Estate Agencies Are Now in Scope

Tranche 2 brings THE REAL ESTATE SECTR under AUSTRAC from 1 July 2026

Agencies that handle property sales, deposits, settlements or manage trust accounts become “reporting entities.”

You must:

Enrol with AUSTRAC within 28 days of first providing a designated service.

Implement a written AML/CTF Program (Part A & Part B).

Perform Customer Due Diligence (CDD/KYC) on every buyer, seller and beneficial owner before accepting funds.

Monitor clients & report suspicious activity: file Suspicious Matter Reports (SMRs), Threshold Transaction Reports (TTRs ≥ A$10 000 cash) and International Funds-Transfer Instructions (IFTIs) where relevant.

Keep records for 7 years & train all staff.

Penalties: AUSTRAC may impose multi-million-dollar civil fines and pursue personal liability for Principals / Compliance Officers for serious breaches.

Ready to get started?

The Five Biggest Risk Areas for Real-Estate

Typical higher-risk scenarios:

Cash deposits ≥ A$10 000 into the agency’s trust account for property purchases.

Off-shore / high-risk-jurisdiction buyers or vendors.

Third-party or complex company purchasers (shell companies, opaque UBO chains).

Politically Exposed Persons (PEPs) acquiring property as investment.

Unusual payment instructions, e.g. buyer splits the deposit into several smaller cash payments.

Red-Flag Awareness: These patterns come from AUSTRAC’s Gatekeeper-Sector Risk Assessment and our own Risk-Assessment Template.

The full Real-Estate Red-Flag Checklist is taught in our e-learning and supplied in the Compliance Guide handed over at the implementation session.

See how WE CAN HELP WITH AML/CTF Compliance

Putting the Pieces Together

Step 1 — Risk Assessment (Free Download)

Start with our Real-Estate-sector Risk-Assessment Excel

Template to map out customer types, geographies, delivery-channels and transaction risks for your agency.

Step 2 — Sector-Specific Compliance Guide (Unlocked via Free Implementation Session)

Book a 30-min session → our specialist walks you through your risk-profile and hands you the Real-Estate AML/CTF Compliance Guide with pre-filled Part A & Part B sections.

Step 3 — Activate Platform + Training

Staff complete our AUSTRAC-aligned e-learning (launch Nov 2025) → you switch-on My Databoss workflows: digital-ID → auto-risk-tier → custom EDD → audit-ready records.

Trusted by

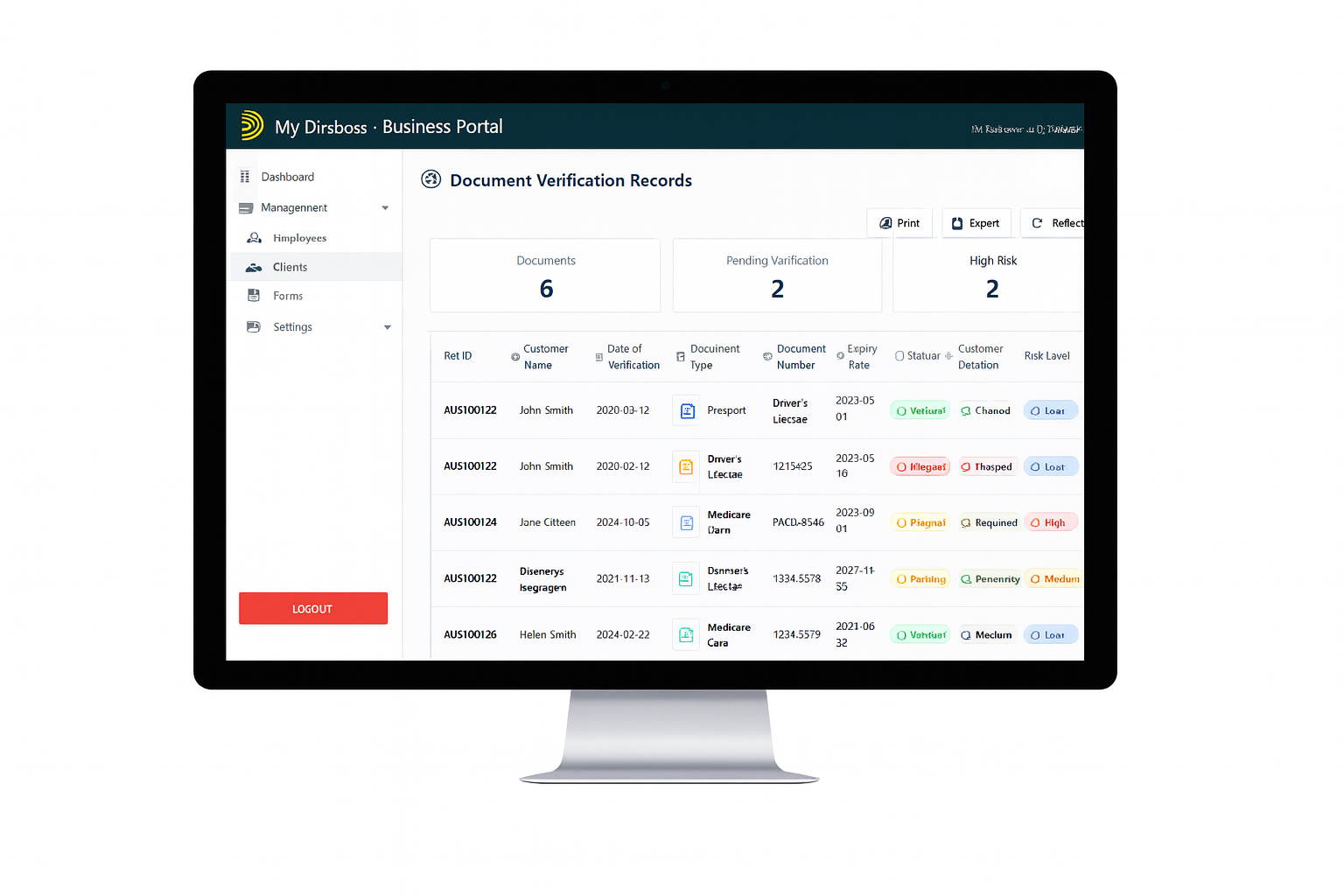

See how AML/CTF fits naturally into a legal matter in My Databoss

Daily Compliance in Practice

Create listing - open file and invite buyer / vendor to secure portal.

Digital-ID + biometric check (100-point ID, liveness detection & biometric-match.

Platform auto-screens PEP / Sanctions / Adverse-Media and assigns Risk-Tier.

High-Risk case, Automatic EDD form + Compliance-Officer approval before deposit accepted into trust account.

All CDD/EDD reports & supporting docs auto-stored 7 years. Dashboards feeds Internal reporting. Keep your firm audit-ready always

Trusted by

Learining HUB

Resources & Learning

[ AUSTRAC – Tranche 2 Reforms Overview ]

[ AUSTRAC – Sector-Specific Guidance ]

[ AUSTRAC – Red-Flag Indicators for Gatekeeper Sectors ]

[ Download Free Risk-Assessment Template (Excel) ]

[ Book Free Implementation Session → Receive Compliance Guide ]

[ Preview AUSTRAC-Aligned E-Learning Course (launch Nov 2025) ]

Why Real Estate Firms Choose My Databoss

Integrated Everything- Risk-Assessment + Guide + Training + KYC workflows + Board-reporting — all in one secure portal.

Real-Estate-Ready- Designed for property-sales workflows: aligns with agency trust-accounts, settlement processes and supports high-volume onboarding

Audit-Ready in Minutes- Version-controlled program docs, risk-logs, SAR register, training register. Ready for AUSTRAC inspection.

Start your AML/CTF journey today — protect your business and stay sales-focused

Ready to Secure Your Business?

Watch a live Demo Now

See My Databoss in Action - No Waiting Required.

Get an exclusive look at how My Databoss streamlines data security, compliance and automation. Watch our on-demand demo to discover how it works - at your convenience.