AML/CTF Tranche 2 Hub

AML Hub for Trust & Company Service Providers (TCSPs) — Powered by My Databoss

All in one secure platform: risk-assessment template → guided implementation session → compliance-program guide → AUSTRAC-aligned training → automated KYC & reporting workflows.

Why TCSPs Are Now in Scope

Tranche 2 brings TCSPs under AUSTRAC from 1 July 2026

TCSP Businesses that provide “designated services” such as:

Forming companies or trusts on behalf of clients,

Providing registered office / business address services,

Supplying nominee directors, shareholders or secretaries,

Acting as trustee or similar fiduciary roles,

become “reporting entities.”

You must:

Enrol with AUSTRAC within 28 days of first offering a designated service.

Implement a written AML/CTF Program (Part A & Part B).

Perform Customer Due Diligence (CDD/KYC) on every client and all beneficial owners/controllers.

Monitor clients & report suspicious activity: file Suspicious Matter Reports (SMRs), Threshold Transaction Reports (TTRs ≥ A$10 000 cash) and International Funds-Transfer Instructions (IFTIs) where relevant.

Keep records for 7 years & train all staff.

Penalties: AUSTRAC can impose multi-million-dollar civil fines and pursue personal liability for Directors / Compliance Officers in serious breaches.

Ready to get started?

The Five Biggest Risk Areas for TCSPs

Typical higher-risk scenarios:

Nominee director or shareholder requested by unknown overseas client with opaque beneficial-ownership.

Trust formation for a client from a high-risk jurisdiction.

Layered company structures (3-plus tiers) with no clear commercial purpose.

Politically Exposed Person (PEP) involved as director / beneficiary.

Payments routed via third-party escrow accounts or unusual split cash deposits ≥ A$10 000.

Red-Flag Awareness: These examples come from AUSTRAC Gatekeeper-Sector Risk Assessment and our own TCSP Risk-Assessment Template. The full TCSP-Sector Red-Flag Checklist is included in our Compliance Guide (unlocked during the implementation session) and taught in our AUSTRAC-aligned e-learning.

See how WE CAN HELP WITH AML/CTF Compliance

Putting the Pieces Together

Step 1 — Risk Assessment (Free Download)

Start with our Accounting-sector Risk-Assessment Excel Template to map out customer-types, services, delivery-channels, geographies and transaction risks for your practice.

Template to map out customer types, geographies, delivery-channels and transaction risks for your agency.

Step 2 — Sector-Specific Compliance Guide (Unlocked via Free Implementation Session)

Book a 30-min session → our specialist walks you through your risk-profile and hands you the Accounting AML/CTF Compliance Guide with pre-filled Part A & Part B sections

Step 3 — Activate Platform + Training

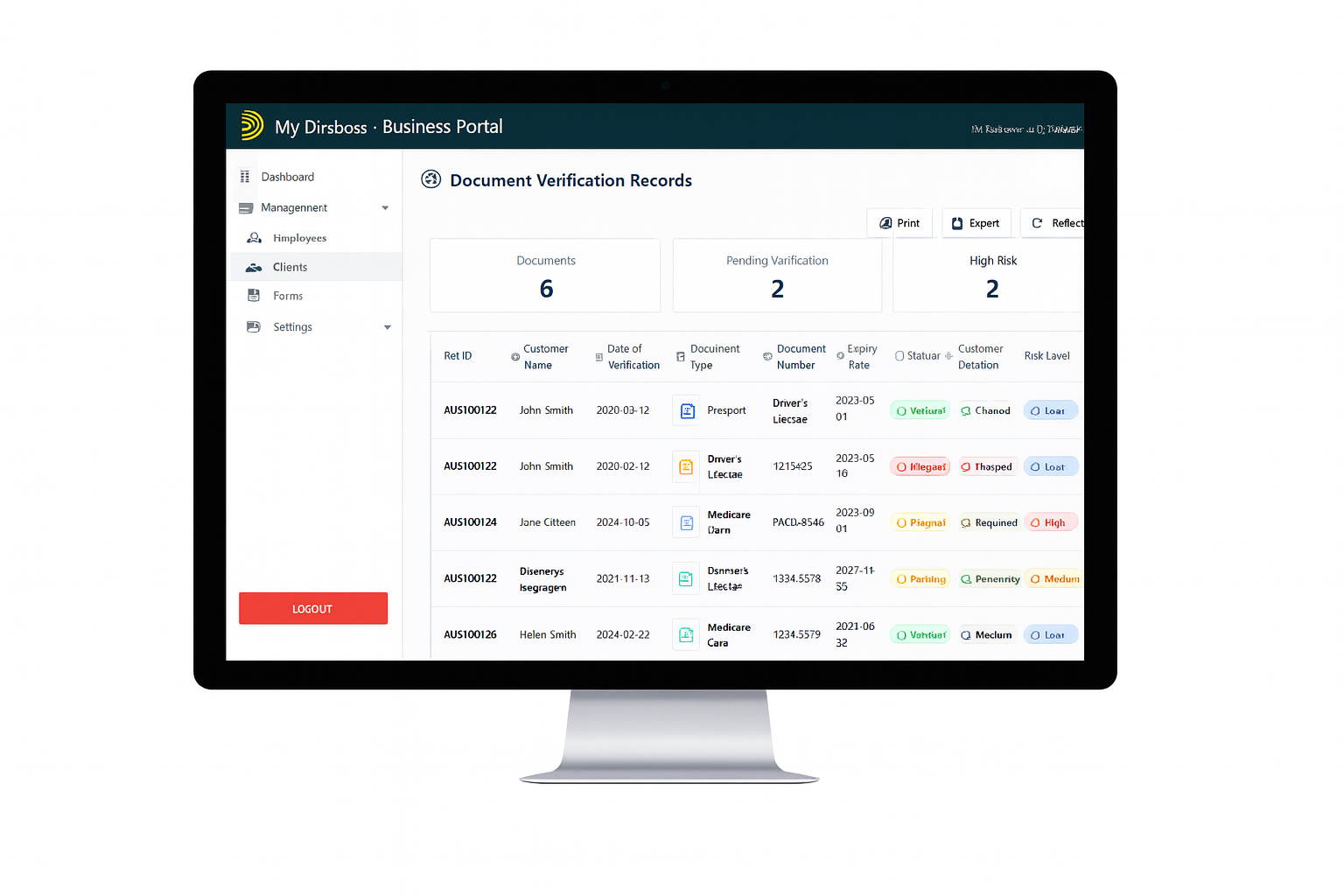

Staff complete our AUSTRAC-aligned e-learning (launch Nov 2025) → you switch-on My Databoss workflows: digital-ID → auto-risk-tier → custom EDD → audit-ready records.

Trusted by

See how AML/CTF fits seamlessly into an accounting engagement in My Databoss

Daily Compliance in Practice

Open new TCSP engagement and invite customer to secure portal.

Digital-ID + biometric check (100-point ID, liveness detection & biometric-match.

Platform auto-screens PEP / Sanctions / Adverse-Media and assigns Risk-Tier.

High-Risk client (e.g. off-shore trust setup) auto-requires EDD form + Compliance-Officer approval before fees accepted or work commences.

All CDD/EDD reports & supporting docs auto-stored 7 years. Dashboards feeds Internal reporting. Keep your firm audit-ready always

Trusted by

Learining HUB

Resources & Learning

[ AUSTRAC – Tranche 2 Reforms Overview ]

[ AUSTRAC – Sector-Specific Guidance ]

[ AUSTRAC – Red-Flag Indicators for Gatekeeper Sectors ]

[ Download Free Risk-Assessment Template (Excel) ]

[ Book Free Implementation Session → Receive Compliance Guide ]

[ Preview AUSTRAC-Aligned E-Learning Course (launch Nov 2025) ]

Why TCSP Firms Choose My Databoss

Integrated Everything - Risk-Assessment + Guide + Training + KYC workflows + Board-reporting, all in one secure portal.

Tailored for TCSP Workflows - Handles complex UBO chains, nominee-appointments, supports multi-entity risk-assessments and regulatory reporting.

Audit-Ready in Minutes - Version-controlled program docs, risk-logs, SAR register, training register — ready for AUSTRAC inspection any time.

Start your AML/CTF journey today — protect your firm and your clients.

Ready to Secure Your Business?

Watch a live Demo Now

See My Databoss in Action - No Waiting Required.

Get an exclusive look at how My Databoss streamlines data security, compliance and automation. Watch our on-demand demo to discover how it works - at your convenience.